Size matters – an analysis of business models and the financial performance of Finnish wood-harvesting companies

Jylhä P., Rikkonen P., Hamunen K. (2020). Size matters – an analysis of business models and the financial performance of Finnish wood-harvesting companies. Silva Fennica vol. 54 no. 4 article id 10392. https://doi.org/10.14214/sf.10392

Highlights

- Economic success was related to company’s size, Small companies with a turnover of less than 600 000 € a–1 are struggling with profitability

- Large enterprises continue to grow and innovate new business concepts

- The competitive edge of large companies was reflected in large production capacity, efficient operations, versatile supply of services, and power in negotiations.

Abstract

The size of Finnish wood harvesting enterprises has grown, and entrepreneurs have become responsible for various additional tasks, resulting in networking with other harvesting enterprises of various sizes and suppliers of supporting services, but the profitability of the wood harvesting sector has remained low. In the present study, the financial performance of 83 wood harvesting companies in Eastern and Northern Finland was evaluated, based on public final account data from a five-year period between 2013 and 2017. The factors underlying economic success were identified based on 19 semi-structured entrepreneur interviews. The Business Model Canvas framework was applied in the analyses. In particular, the smallest companies (with an annual turnover of less than 600 000 €) struggled with profitability. They showed increasing indebtedness, suffered from poor power in negotiations, had typically short-term contracts, and faced difficulties in retaining skilled operators. Most of the small companies were subcontractors of larger wood-harvesting companies. The better economic success of larger companies was likely based on their capacity to provide wood harvesting services in large volumes and supply versatile services, power in negotiations, and more cost-effective operations. The future development of wood harvesting seems to be polarised: larger enterprises are likely to continue growing, while the size of smaller enterprises has stabilised. Enhancing business management skills and practices is required in enterprises of all size groups.

Keywords

profitability;

business model;

business model canvas;

entrepreneur;

success factor;

wood-harvesting enterprise

-

Jylhä,

Natural Resources Institute Finland (Luke), Production systems, Teknologiakatu 7, FI-67100 Kokkola, Finland

E-mail

paula.jylha@luke.fi

- Rikkonen, Natural Resources Institute Finland (Luke), Bioeconomy and environment, Lönnrotinkatu 7, FI-50100 Mikkeli, Finland E-mail pasi.rikkonen@luke.fi

- Hamunen, Natural Resources Institute Finland (Luke), Bioeconomy and environment, Yliopistokatu 6B, FI-80100 Joensuu, Finland E-mail katri.hamunen@luke.fi

Received 5 June 2020 Accepted 16 September 2020 Published 22 September 2020

Views 80423

Available at https://doi.org/10.14214/sf.10392 | Download PDF

1 Introduction

The forest sector is a major contributor to Finland’s national economy. In 2019, the forest industry was responsible for 19% of the value of exports (Finnish Customs 2020). With forestry, it employed ca. 66 000 people in 2019 (Natural Resources Institute Finland 2020a). The forest industry invested ca. 7.6 billion euros in infrastructure, machinery, and incorporeal assets during the 10-year period from 2007 to 2017 (Statistics Finland 2019). In 2018, a new record of 78.2 million cubic metres (solid over bark) of roundwood removal was set, with gross stumpage earnings of 2.7 billion euros (Natural Resources Institute Finland 2020a). Wood-harvesting entrepreneurs are responsible for the raw material supply of the forest industry. They also provide job opportunities, especially in areas with low economic diversity. Felling and forest haulage of industrial roundwood directly employed an average of 5400 people in Finland in 2019 (Natural Resources Institute Finland 2020a).

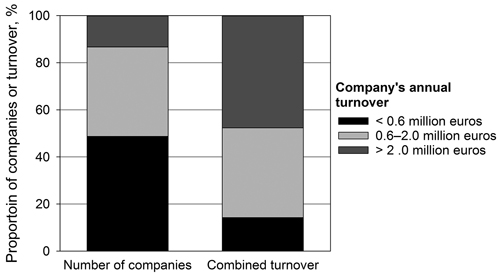

To be efficient, the forest industry has an incentive to negotiate with fewer and larger counterparts capable of providing versatile services (Penttinen et al. 2011; Soirinsuo 2012; Kronholm et al. 2019). Wood harvesting enterprises can improve their capacity to serve big customers by networking with other enterprises, investing in production capacity, or buying other enterprises (Penrose 2009; Penttinen et al. 2011). The emergence of small subcontracting firms and the development of large wood-harvesting companies with multiple services have been the most distinctive changes in the Finnish wood-harvesting business in the 2000s (Soirinsuo 2012). In 2017, 49% of the wood-harvesting members (limited liability companies) of the Trade Association of Finnish Forestry and Earth Moving Contractors had an annual turnover of less than 0.6 million euros (Fig. 1). These companies were responsible for 13% of the combined turnover of ca. 380 million euros (The Trade Association of Finnish Forestry and Earth Moving Contractors 2020).

Fig. 1. Distribution of the numbers and combined turnover into turnover classes (less than 0.6 million euros, 0.6–2.0 million euros, more than 2.0 million euros) of the wood-harvesting members (limited companies) of the Association of Finnish Earth Moving and Wood Harvesting Contractors in 2017 (n = 353) (The Trade Association of Finnish Earth Moving and Wood Harvesting Contractors 2020).

Since the renewal of competition legislation in 1992 (Laki kilpailunrajoituksista 1992), wood-harvesting prices in Finland have been based on competitive bidding or bilateral negotiations between the wood-harvesting entrepreneur and the customer instead of national agreements. Several studies show declining trends in the profitability of wood-harvesting between 1994 and 2012 (Väkevä et al. 1999; Väkevä and Imponen 2001; Kärhä 2004; Soirinsuo and Mäkinen 2009; Manner and Järvinen 2013). Recent statistics of the Trade Association of Finnish Forestry and Earth Moving Contractors show continuing declining trend in profitability. In 2018, salary-corrected operating profit was only 0.9% for a median wood-harvesting company in terms of turnover (The Trade Association of Finnish Earth Moving and Wood Harvesting Contractors 2019), while 10% is considered a good value within the sector (Mäkinen 2018). In Sweden, low profitability in the wood harvesting industry has been reported since the second half of the 1990s (Murphy et al. 1996; Hultåker 2006; Kronholm et al. 2019).

Today, wood-harvesting enterprises provide a wide range of services (e.g. planning and administration, silvicultural services, and transportation; Kronholm et al. 2019). Due to increased entrepreneurial orientation, individuals coordinating the supply of the above services are considered entrepreneurs rather than contractors (Soirinsuo and Mäkinen 2009). During the past ten years, the popularity of business model analysis has increased research into the success factors of enterprises. In general, a business model describes how firms create, market, and deliver value to their customers (Magretta 2002; Osterwalder and Pigneur 2005; Teece 2010). A thorough analysis of business model components can reveal the strengths and development needs of an enterprise. Such analyses also expose how an enterprise differs from its competitors and draws attention to crucial activities and resources. The lack of a clear business model increases an enterprise’s risk of failure in delivering or capturing value from their innovations (Teece 2010).

Economic success is an essential part of a business model. When examining the financial performance of a certain business branch over time, attention is usually paid to the liquidity, financial solidity, and profitability of enterprises (Murphy et al. 1996; Penttinen et al. 2011). These financial ratios are also interesting to various stakeholders, such as investors, owners, and customers. They can be analysed in terms of the strengths and weaknesses of enterprises in the business sector, and they have proved important predictors of their development and performance (Penttinen et al. 2011; Laitinen and Lukason 2014; Winquist et al. 2019).

In the present article, we analyse the financial performance and success factors of limited liability wood-harvesting companies in Eastern and Northern Finland by applying the modified business model canvas (BMC) framework originally developed by Osterwalder and Pigneur (2010). To capture sustainable operating practices and value creation in the supply chain, in-depth interviews of entrepreneurs were combined with the available final account data. This study aims to answer the following questions:

1. What was the financial performance of wood-harvesting companies of various sizes between 2013 and 2017?

2. What are the main differences and development needs in the business models applied by companies of various sizes?

3. What are the internal and external factors affecting the future development of the wood-harvesting business?

2 Material and methods

2.1 Data composition

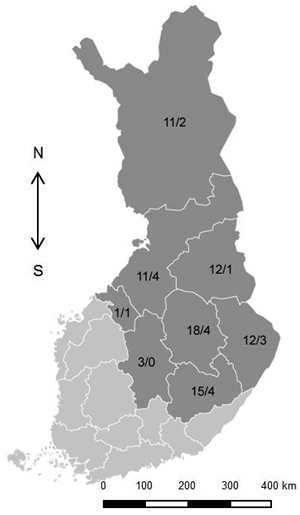

The status of the Finnish wood-harvesting business was evaluated based on financial and interview data from Eastern and Northern Finland (Fig. 2). These regions were responsible for 63% of industrial roundwood removals in Finland in 2018 (Natural Resources Institute Finland 2020a). Due to the availability of final account data, only limited liability companies (Ltd) were included in the analysis. Financial data covering the five-year period between 2013 and 2017 was obtained from the national Voitto+ database, which included the final accounts of 1151 wood harvesting companies (Ltds) for 2017 (Suomen Asiakastieto Oy 2018). Of these, 633 were registered in Eastern and Northern Finland in 2017. A sample of 83 companies of various sizes was selected from them for economic analysis. Selection of these companies were based on available information on the Internet, and those running other than wood harvesting as their main business were excluded. Thereafter, the sample of 83 companies was divided into three groups (S = Small, M = Medium, L = Large) based on their annual turnover, as shown in Table 1. The turnover includes the company’s actual income from business operations, from which the value-added tax and other taxes based directly on the amount of sales have been deducted (CCA 2013).

Fig. 2. Study area and the numbers of wood harvesting companies included in the financial analyses and interviews (economic analyses/interviews) by regions of Eastern and Northern Finland.

| Table 1. Categorisation of the wood harvesting companies (limited liability companies) included in the financial analyses and interviewed. | |||

| Turnover class | Annual turnover, million euros | Number of companies included in the financial analysis | Number of companies involved in the interviews |

| Small (S) | <0.6 | 31 | 8 |

| Medium (M) | 0.6–2.0 | 34 | 7 |

| Large (L) | >2 | 18 | 4 |

To analyse and understand the business models and operational environment behind the economic performance, 19 entrepreneurs were selected for in-depth interviews from the 83 companies included in the financial analyses. In all, 27 managing directors (males) were contacted, of which eight declined due to a lack of time. The aim was to form a geographically balanced set that represented all size groups in terms of companies’ annual turnover. Due to small sample sizes, the geographical location has been omitted in presenting the results.

2.2 Financial analyses

Essential ratios from the companies’ final accounts were selected to describe their financial performance between years 2013 and 2017. The financial ratios were obtained from the database of Asiakastieto Oy (2018). They include liquidity, financial solidity, and profitability, calculated as presented in CCA (2013). Liquidity (Eq. 1) was analysed based on Quick Ratio, which indicates the ability of current assets to meet short-term liabilities.

The debt ratio (%; Eq. 2) was used as an indicator of solidity. It measures an enterprise’s ability to meet its debt obligations.

![]()

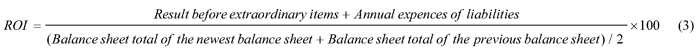

Return on investment (ROI, %) was used in assessing enterprises’ relative profitability. ROI relates profits to capital invested as follows:

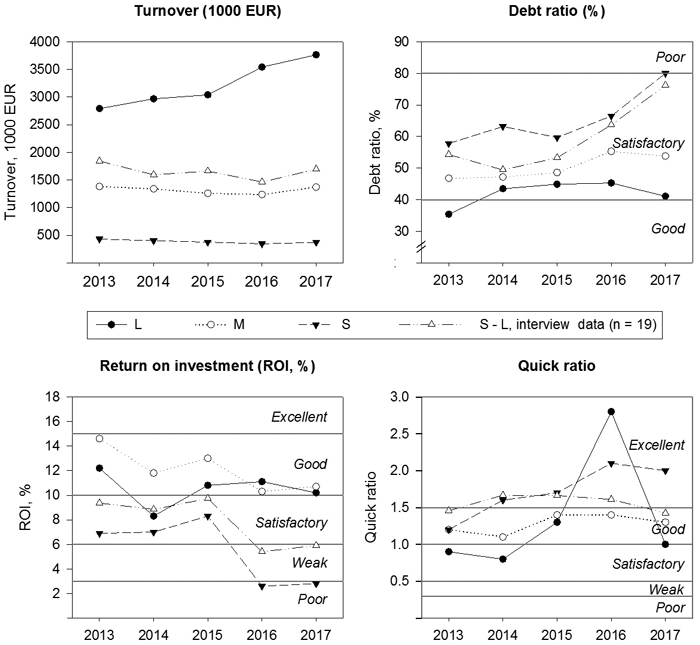

The Finnish reference values for the financial ratios above (CCA 2013) are presented in Fig. 4.

2.3 Interviews

Semi-structured interviews were conducted by two researchers by telephone (n = 12) or face to face (n = 7). The questionnaire form included both structured and open questions. Part of the questions provided classes or scales from which the respondents selected the most appropriate (e.g. Likert scale) values, or the answers were numerical. Descriptive statistics were calculated from these responses. When analysing open responses, thematic coding was used, and the scales or classes were defined in the analysing phase (Boyatzis 1998).

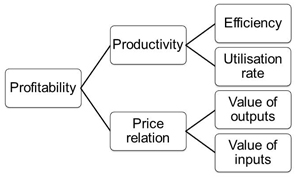

The interviews were aimed at identifying the factors affecting the success of the companies, focusing on the profitability elements of wood harvesting, as defined by Hourunranta (2013) (Fig. 3). The questions were created by applying the BMC approach developed by Osterwalder and Pigneur (2010) and modified for forestry service businesses by Benjaminsson et al. (2019). Instead of the original nine business model components, however, the research questions were operationalised under the following five headings with key questions: customers and contracts, human and material resources, organisation of activities, business management, and business development (Table 2). The aim of the key questions from a to j was to assess the key elements of profitability illustrated in Fig. 3. Business development scenarios (key questions k to l) were explored using a SWOT analysis (the acronym for strengths, weaknesses, opportunities and threats; Kotler 1988; Wheelen and Hunger 1995), in which the respondents identified the main internal and external factors that are important to the future of their companies. The final account data provided the background information for the further examination of the applied business models, especially regarding the prerequisites for long-term success.

Fig. 3. The elements of profitability of a wood-harvesting enterprise – Hourunranta’s (2013) modification of the REALST model by van Loggerenberg and Cucchiaro (1981).

| Table 2. Key questions and examples of economic performance indicators in the business model analysis. | ||

| Business model component | Key questions | Examples of performance indicators |

| Customers and contracts | a) Who is the paying customer? | Types of customers (e.g. another wood harvesting enterprise, a forest industry company, and state forests) |

| b) How stable are the contracts? | The duration of the contract | |

| c) Who has the power in negotiations? | The role in the supply chain (subcontractor vs. prime contractor) The basis of the contract (bidding vs. negotiation) | |

| d) Does economic success depend on the services provided? | The services provided by the companies | |

| Human and material resources | e) What are the key competences of a successful company? | The managerial competence of the entrepreneur The educational background of the personnel |

| f) Are there differences in human capital? | The age of the company The allocation of responsibilities within the company | |

| g) Are resources used efficiently? | The degree of machinery utilisation The work-time allocation of the entrepreneur | |

| Organisation of activities | h) Is the entrepreneur’s work input clear in terms of profitability creation? | Annual working hours of the entrepreneurs |

| i) Are the operations organised cost-effectively? | The degree of machinery utilization The radius of the operation area The size of the site reserve The organisation of machine relocation and maintenance | |

| Business management | j) Is a systematic follow-up of the financial situation and operational efficiency seen in profitability? | The intensity of financial and operational monitoring |

| Business development | k) What are the factors affecting the future success of a wood-harvesting enterprise? | The respondents’ perception of strengths, weaknesses, opportunities, and threats of their businesses |

| l) Is there a need to develop the business model for the company’s survival? | The development plans identified by the respondents | |

3 Results

3.1 Financial performance

The mean turnover of only the largest companies increased during the five-year period between 2013 and 2017 (Fig. 4). The overall profitability within the sample of 83 companies (5 × 83 observations) was satisfactory, with a mean ROI of ca. 7% (see CCA 2013, Fig. 2). In the L and M turnover classes, profitability remained good (ROI > 10%) most of the time, while the smallest companies struggled with profitability. The smallest companies were also more debt-ridden than the larger ones. However, the mean debt ratio of all companies remained at least satisfactory, though the trend of the smallest firms showed increasing indebtedness. This was also the case among the companies contributing to the interviews, and the variation in their debt ratio was greatest among the S companies (Table 3). Short-term liquidity (quick ratio) was good or excellent in all groups, indicating that the companies had sufficient cash and equivalents, marketable securities, and accounts receivable to serve short-term debt. The fluctuation in the quick ratio was also moderate except in the largest companies.

Fig. 4. Time series of the mean financial indicators for the 83 wood harvesting companies from Northern and Eastern Finland by turnover class (S = Small; M = Medium; L = Large), 2013–2017 (see Table 1). The figures for the 19 companies contributing to the interviews were combined. Reference values for debt ratio, ROI and quick ratio according to CCA (2013).

| Table 3. The financial indicators of the 19 wood harvesting companies included in the interview data from Eastern and Northern Finland, 2013–2017 (Sd = standard deviation). | ||||||

| Turnover class | ||||||

| Small (n = 8) | Medium (n = 7) | Large (n = 4) | ||||

| Mean | Sd 1) | Mean | Sd 1) | Mean | Sd 1) | |

| Turnover, 1000 euros | 480 | 156 | 1100 | 480 | 4100 | 236 |

| ROI | 3.1% | 10.4 pp | 7.9% | 6.3 pp | 7.4% | 3.9 pp |

| Debt ratio | 77% | 31 pp | 44% | 15 pp | 43% | 13 pp |

| Quick ratio | 1.81 | 0.59 | 1.59 | 0.52 | 0.97 | 0.42 |

| 1) Figures are based on five-year values (in all 95 observations). Standard deviations of percentage values are expressed in percentage points (pp). | ||||||

The mean turnover of the companies involved in the interviews ranged from 0.3 million euros to 7.9 million euros during the examined period. The turnover varied considerably between years and enterprises, but the trend was that the largest companies grew, and the turnover of the smallest stayed at the same level. The mean ROI of the M and L companies remained good most of the time, while that of the smallest companies declined from satisfactory to poor by the end of the study period, with a greater variation than in the other turnover classes. The smallest enterprises were also the most indebted.

Half of the respondents estimated that the overall profitability of their business had been good or excellent (from 4 to 5 on the Likert scale) five years earlier (2013–2014). Based on the financial data only, three companies achieved that level. For the rest, it varied from poor to satisfactory.

3.2 Analysis of the business models

3.2.1 Customers and contracts

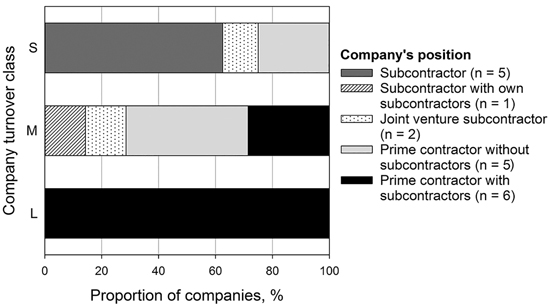

The roles the companies in the wood supply chain are illustrated in Fig. 5. S companies were typically subcontractors of prime contractors serving forest industry companies. Most of the M enterprises had direct agreements with clients responsible for roundwood procurement for the forest industry, such as Metsähallitus (the State Forest Enterprise), forest management associations (FMA), or jointly owned forests. Three also had their own subcontractors; one of these was at the same time a subcontractor for a larger wood-harvesting company. The L enterprises were prime contractors with direct agreements with the forest industry or FMAs, and all had their own subcontractors. One S and one M company were formally subcontractors, but they were also shareholders of joint ventures responsible for signing agreements with the forest industry.

Fig. 5. The roles of the wood harvesting companies, based in Eastern and Northern Finland, in the wood supply chain.

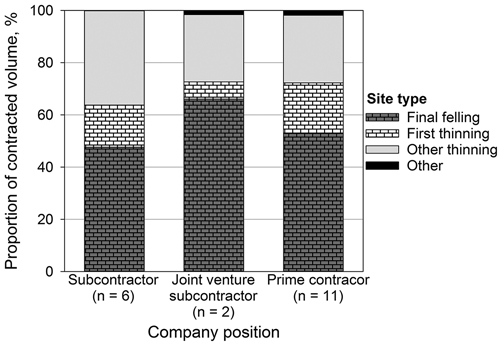

The total contracted volume (m3), the number of customers, and mean contract volume were proportional to the company’s turnover class (Table 4). Average annual harvesting volume per customer varied from 38 800 to 184 400 m3. That of the L companies was nearly five times that of the smallest firms and three times that of the M companies. Mean harvesting volumes for first and subsequent thinnings and final felling sites were ca. 820, 780, and 540 m3 per site respectively. The M companies had by far the largest sites, but the size of an individual harvesting site (“block”) depended on the final customer of the harvesting service rather than the company’s turnover or position in the supply chain. The sites offered by Metsähallitus and jointly owned forests were by far the largest in all site types. Slight differences were found in the site type distribution between prime contractors and subcontractors, but the final allocation of contracted sites between these company groups is unknown (Fig. 6). Most prime contractors emphasised that no difference exists in the site distributions allocated to their machinery and subcontractors, and the subcontractors with dedicated operation areas were most satisfied with their site distributions. Moreover, the tendency was to outsource more forwarding than cutting. The M and L companies were well established: their business relationships had lasted for between 15 and 17 years, whereas the clients of the smallest companies changed every three years on average.

| Table 4. Characteristics of customers and contracts of wood harvesting companies in Eastern and Northern Finland by turnover class based on entrepreneur interviews (n = 19). | |||

| Company turnover class | |||

| Small (n = 8) | Medium (n = 7) | Large (n = 4) | |

| Mean number of customers | 1.4 | 1.9 | 2.8 |

| Average total contracted volume, m3 a–1 | 48 400 | 139 300 | 461 000 |

| Average harvesting volume per customer, m3 | 38 800 | 88 600 | 184 400 |

| Duration of the customer relationship, years | 3 | 17 | 15 |

Fig. 6. The distribution of the contracted volume (m3) into site types by company role in the wood supply chain in Eastern and Northern Finland. The final allocation of contracted sites between the contractors and their subcontractors is unknown.

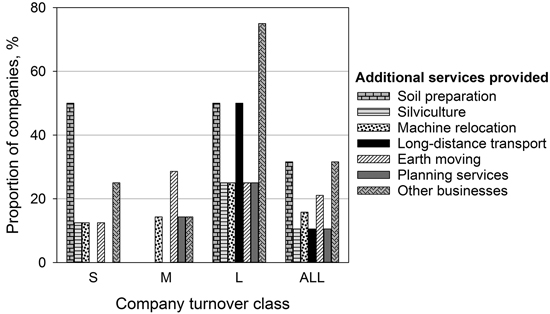

Wood harvesting constituted 70% to 100% of the company turnover. Half of the companies specialised in wood harvesting (including harvesting energy wood) and provided no other service. The proportion of such firms was largest among the M companies (Fig. 7). Furthermore, the side-line businesses of the M companies constituted only a minor part of their turnover. Typically, existing machinery or other facilities were used in the side-line businesses that were primarily related to forestry. Soil preparation and earth-moving services were common services, but their profitability was considered poor in many cases.

Fig. 7. Additional services provided by the wood harvesting companies (n = 19) in Eastern and Northern Finland by turnover class.

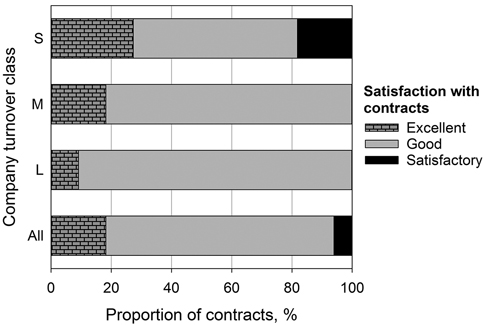

As a state-owned enterprise, Metsähallitus is obliged to follow public procurement rules, and the agreements between it and the wood-harvesting companies (n = 4) were therefore based on competitive bidding. In other cases, contracts were based on negotiations, but some of the entrepreneurs felt they had no power in negotiations and that the conditions of the agreements were dictated. Yet customer relations were considered at least satisfactory (Fig. 8). All respondents representing the largest enterprises were satisfied with their work as wood-harvesting entrepreneurs. The poor profitability of the smallest companies was reflected in weaker satisfaction, as only 50% of the respondents were satisfied with their profession.

Fig. 8. The entrepreneurs’ evaluation of the quality of the business relationships with their clients by company turnover class. The assessment included 33 out of 35 business relationships of the 19 wood-harvesting companies based in Eastern and Northern Finland.

Wood-harvesting prices were primarily based on the type of cutting (thinning vs. final felling), mean stem volume, and forwarding distance. Three prime contractors and one subcontractor were responsible for practical site planning (including routing, storage areas, demarcation of the harvesting area, etc.), and compensation for this additional work was paid to two of them, on either an area or hourly basis. The companies of the remaining 15 respondents received work plans from their customers. Their quality was considered inadequate in many cases because planning was often done without visiting the harvesting site. This caused extra work and costs for the entrepreneur.

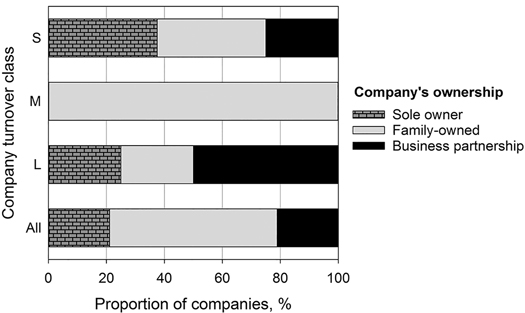

3.2.2 Human and material resources

The oldest businesses were established in the 1960s and 1970s, but most enterprises were established in the 1990s and 2000s. The M companies had the longest traditions. Their contracting business had continued for an average of 38 years by the interviews, while the S and L companies had started an average of 19 and 28 years earlier respectively. Five out of eight entrepreneurs running the S companies had established the business themselves, while most of the owners of the larger companies were continuing business initiated by their families. All M companies were family-owned, while ownership in the other size classes was more scattered (Fig. 9).

Fig. 9. Ownership of the wood harvesting companies in the interview data from Eastern and Northern Finland (n = 19).

The total number of companies’ owners varied between one and four (including juridical persons). Most S companies (6 out of 8) had only one active owner involved in daily activities. In the M class, only two companies were run by a sole owner, while in the largest companies, between one and three owners worked for the company. The majority of the employees were forest machine operators (Table 5). In three or four companies, lease work was also undertaken during peak seasons. Only two of the largest companies had recruited supervisors outside the ownership to manage practical operations.

| Table 5. Summary of the utilisation of human and corporeal resources by turnover class in the wood harvesting companies in Eastern and Finland. Only employees responsible for wood harvesting are included. The business mediator company was excluded when calculating the figures for machinery. | |||

| Turnover class | |||

| Small (n = 8) | Medium (n = 7) | Large (n = 4) | |

| Mean number of active owners | 1.2 | 1.6 | 1.8 |

| Mean number of employees | |||

| Operators | 2.5 | 10.4 | 14.0 |

| Supervisors etc. | - | - | 1.3 |

| Office staff and planners | - | - | 0.8 |

| Mean number of own harvesters | 1.4 | 3.4 | 6.7 |

| Mean number of own forwarders | 1.5 | 3.1 | 5.7 |

| Mean age of the machines, a | 6 | 3 | 4 |

| Number of harvester’s annual engine hours | 2600 | 2900 | 3100 |

| Number of forwarder’s annual engine hours | 2300 | 2300 | 2900 |

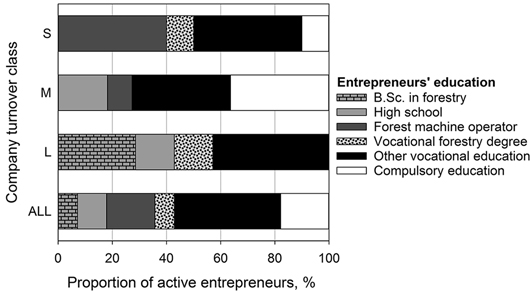

Most of the active owners had gained forest machine operator or other low-level qualifications from the business management perspective: typically, vocational training outside forestry (Fig. 10). However, three owners or other family members involved in the business in the M and L companies had vocational degrees in business management and accounting. The forest machine operator qualification was the most common among entrepreneurs running the smallest companies. Only a few entrepreneurs had higher-level education in forestry.

Fig. 10. Active entrepreneurs’ educational degrees by turnover class in the wood harvesting companies in Eastern and Northern Finland (n = 19).

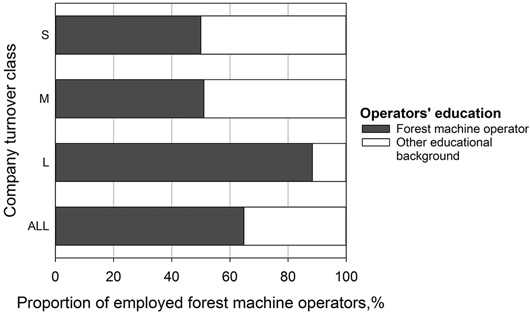

About three-fourths of the companies had faced difficulties in recruiting and retaining skilled and motivated operators. Several respondents from the smallest companies reported that they had trained inexperienced operators or provided forwarder operators training for harvesters, but good-quality machinery, higher salaries, and other benefits offered by larger enterprises had resulted in their leaving to work for these employers. The proportion of forest machine operators with formal training increased with the increase in a company’s size (Fig. 11), which supports the statement above.

Fig. 11. Educational background of forest machine operators (employees) in the wood harvesting companies in Eastern and Northern Finland by turnover class (n = 19).

Typically, S companies had one or two own harvesting chains comprising a harvester and forwarder, while the largest companies had between five and eight (Table 5). The proportion of forwarders of harvesting machinery was slightly higher among the S companies than in the other size classes. One company had outsourced all harvesting work to its subcontractors, and it acted as a business mediator responsible for coordinating harvesting operators. The machines used by the S companies were an average of six-years-old, while larger companies’ machines were an average of three- or four-years-old. Small companies that had recently invested in new machinery had low ROI and high debt ratios, while the financial indicators of larger companies seemed independent of the age of machinery.

Based on the number of annual engine hours, the utilisation rate of the M and L companies’ machines was higher than that of the S companies (Table 5). Seasonal variation in harvesting caused both overtime and lay-off periods, but the situation had been under control in recent years due to favourable weather conditions with dry summers and cold winters, as well as high demand for roundwood. Lay-offs during thaws and low demand for services were avoided in most cases by the timing of holidays and mandatory training, or by offering work in other businesses. Nearly all (17) companies had their own trailer for machine relocations.

3.2.3 Organisation of activities

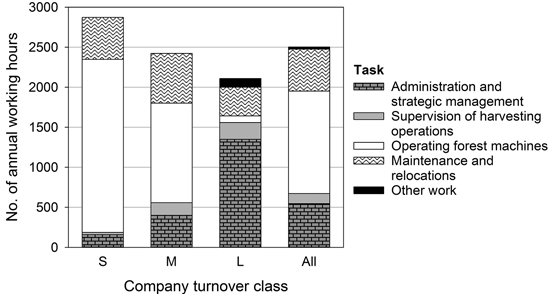

Typically, the companies’ active shareholders worked ca. 2500 hours annually for the enterprise, and the work input was larger the smaller the company was. Their mean working hours by size classes were 2870, 2420, and 2110 respectively (Fig. 12). In many cases, the lack of employees forced the entrepreneurs to work long days by themselves or run operations in only one shift, although most companies (7 out of 8) had recruited forest machine operators.

Fig. 12. Active shareholders’ annual working hours by work type and turnover class in wood harvesting companies in Eastern and Northern Finland (n = 19).

The active owners of the smallest companies focused on operating forest machines, while their peers in the larger companies concentrated on management and administration (Fig. 12). Small enterprises focused on operative daily or weekly planning, whereas medium and large enterprises also allocated time for strategic planning with a timespan of up to three years. Maintenance and translocation of machinery were time-consuming tasks in all size classes. Only two of the largest enterprises had recruited a person for translocations, maintenance, and other supporting tasks. In half (8 out of 15) the S and M companies, entrepreneurs did machine transfers by themselves, while in the other companies operators were also responsible for them. Typically, retired relatives also still helped with machine relocations and maintenance. In one company, all machine transfers were outsourced, while in the others, transfer services provided by external suppliers were used only occasionally. In the L enterprises, operators’ worktime was not allocated to machine transfers.

The radius of the operation area depended on the enterprise’s location and size. Enterprises working in Northern Finland had the greatest distances to cover. The reserve of harvesting sites was related to the enterprise’s size and position in the supply chain. According to several subcontractors, their timespan covered only the subsequent site, while larger prime contractors had site reserves for up to six months. However, the site reserves had slightly increased in recent years. In some cases, both the subcontractor and the prime contractor had dedicated geographical areas (e.g. municipality) to their own responsibilities.

In regular maintenance and repairs, the enterprises had different strategies: a third of the enterprises maintained and repaired the machines as much as possible by themselves, but most had signed contracts for maintenance, especially for new machines. Cooperation with nearby harvesting enterprises, including machine transfers, borrowing of replacement parts, and assisting with forwarding, was usually informal. Joint purchasing agreements for consumables or even machines were also made.

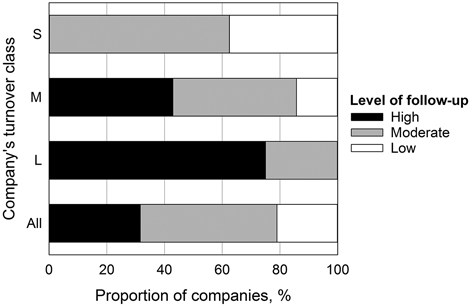

3.2.4 Business management

The level of monitoring profitability and operational parameters depended on the company’s size – the larger the company was, the more comprehensive the follow-up (Fig. 13). At the lowest level, profitability was followed based on monthly reports provided by an external accountant, and fuel consumption was also monitored. Follow-up was more systematic in the largest companies, where follow-up was site-, task-, machine-, or operator-specific (moderate level shown in Fig. 13). The use of specific fleet management software developed for monitoring operational efficiency was most common in the largest companies (high level shown in Fig. 13). In some of the small enterprises, follow-up was seen as pointless due to the small scale of the operation, established practices, and predetermined costs.

Fig. 13. The level of follow-up of profitability and operational parameters in the wood harvesting companies in Eastern and Northern Finland by turnover class (n = 19).

Companies’ owners could draw income from the company in the form of salary and capital income (dividends). Due to poor profitability, some S company owners were unable to draw any capital income, while dividends were paid in all enterprises in the larger size classes. Also salaries paid to the owners in S companies were often low. The primary entrepreneurs’ (the owners with the greatest work input) average income (including salaries and capital income) per working hour (see Fig. 12) was 15 € h–1 in the S companies (n = 7), while in the M and L companies (n = 7 and 2), it was 1.3- and 3.9-fold respectively.

3.2.5 Business development

The internal and external factors affecting the future of the companies, identified by the respondents in the SWOT analysis, are summarised in Table 6. A positive image based on quality, reliability, and long experience was identified as a common success factor for all turnover classes. Competent personnel were considered the core strength in all turnover classes, especially in L companies, where the loss of employees was not a concern. The respondents from these companies also considered the size of the firm to be a significant strength. The respondents from S companies considered the weak position in negotiations to be the most significant weakness.

| Table 6. Internal and external factors affecting the success of the business, identified by the respondents representing various turnover classes (S–L) of wood harvesting companies (limited liability companies) in Eastern and Northern Finland (n = 19). The figures represent percentage of respondents in each turnover class. | ||||||||

| % of respondents 1) | % of respondents 1) | |||||||

| S | M | L | S | M | L | |||

| INTERNAL | Strengths | Weaknesses | ||||||

| Quality and reliability of services | 75 | 71 | 50 | Vulnerability due to scarce human resources | 25 | 43 | - | |

| Long experience and good reputation | 50 | 57 | 75 | Poor profitability of the business | 25 | - | 25 | |

| Competent personnel | 13 | 43 | 100 | Weak power in negotiations | 38 | - | - | |

| Good-quality and reasonable machinery | 37 | 71 | - | Lack of skilled operators | 25 | 14 | - | |

| Flexibility in meeting customers’ demands | 38 | 29 | 25 | Inefficiency of operations | - | 29 | - | |

| Size of the company | 13 | - | 50 | Dependence on a single business branch | - | 14 | 25 | |

| Inadequate leadership and management skills | 13 | - | 25 | |||||

| Old machinery | 25 | - | - | |||||

| Lack of successor for the business | 13 | 14 | 25 | |||||

| EXTERNAL | Opportunities | Threats | ||||||

| Expansion of the business | 38 | 29 | 75 | Fluctuation in the global economy | 63 | 14 | - | |

| New services beyond wood harvesting | 25 | 29 | 25 | Loss of employees | 38 | 29 | - | |

| New investments by the forest industry | 25 | 14 | - | Forest and climate policy | 13 | 14 | 50 | |

| Business exit | - | 14 | - | Harvesting prices too low (competition) | 25 | 14 | - | |

| Seasonal variation | 13 | 14 | - | |||||

| Risk of losing contracts | - | 29 | 25 | |||||

| 1) Proportion of respondents within each turnover class | ||||||||

The projected investments of the forest industry increased the respondents’ faith in the future, and the respondents from the largest companies were especially willing to expand their activities. In some cases, expansion was considered a means of survival because the forest industry prefers contracts with large volumes and versatile services. The owners of the largest enterprises were even interested in timber purchases or taking responsibility for serving all forestry industry integrations in their operating area, but forest and climate policy was considered a threat. Business fluctuation, the loss of employees, and low harvesting prices were viewed as the greatest threats among the respondents from the S companies. The entrepreneurs from the M and L companies recognised the need to enhance their business management skills. Change in ownership was a topical issue in about one-third of the companies, and concerns about the continuation of the business after retirement were common in all turnover classes.

4 Discussion

In the present study, a mix of different methods was used. This approach is considered well-suited to research in which pragmatism is sought (Feilzer 2010). In-depth interviews combined with financial information provided added value that could not have been attained with surveys or qualitative approach alone. However, the results are based on a limited number of cases, and direct connections between the financial indicators and individual business model features cannot be demonstrated based on the available data. The company turnover distributions in the final account and the interview data were in accordance with the database from the Trade Association of Finnish Wood Harvesting and Earth Moving Contractors (2020), which covers approximately 50% of the combined turnover of the Finnish wood-harvesting branch.

The financial ratios included in the present study have been proved to be important predictors of company development and performance (Penttinen et al. 2011; Laitinen and Lukason 2014; Winquist et al. 2019). The turnover of the largest companies exhibited an increasing trend, but profitability did not improve accordingly. The smallest companies had declining profitability and increasing indebtedness. The majority of these companies were subcontractors for larger wood-harvesting companies. Despite the weak profitability and increased debt ratio, their liquidity remained good. Due to the unsustainably high number of working hours (Fig. 12), the estimated hourly income of some primary entrepreneurs of the S companies was less than the minimum wage of an inexperienced harvester operator at 13.34 € per hour (Metsäkonealan työehtosopimus 2018).

The lack of transparency in financial accounting and the varying indicators make benchmarking difficult. Kronholm et al. (2019) reported a median ROI of 3.3% for harvesting contractors operating in Northern Sweden during the five years from 2012–2016. In their survey, the lowest profitability was recorded for the smallest companies with an annual turnover of less than 250 000 euros and the median net profit margin (Murphy et al. 1996) in this group was only 0.8%. The solidity and liquidity ratios follow the equivalents in Finland; the economic stability appears to be at a rather good level, despite struggling with profitability.

Good customer relationships are considered a success factor for wood-harvesting enterprises (Mäkinen 1997; Erlandsson and Fjeld 2017). In the present study, the satisfaction of entrepreneurs with the customer relationship and their work depended on the company size and economic success, but the satisfaction of the clients was not investigated. Eriksson et al. (2017) found that customer-contractor alignment was a key objective for business success and concluded that the performance of the entire wood supply chain could be enhanced by this approach. However, the alignment explained only a minor part of the variance in profitability in their study, and they concluded that most competitive advantages lay in the internal factors of enterprises.

The present study indicates that large enterprises have a competitive advantage over smaller ones. They can operate more efficiently due to higher-capacity machinery utilisation and larger site reserves. Moreover, better benefits attract skilled forest machine operators. In addition to a large production capacity, a versatile supply of services increases their power in negotiations with large industrial customers, and long-time contracts increase the stability of the business. In addition, their business management practices are more developed. The respondents from the L companies had faith in the future, and they were willing to expand their capacity. All turnover classes exhibited an interest in providing new services beyond wood harvesting.

The importance of operator skills and motivation has increased along with the diminishing differences in the capacity and functionality of harvesting machinery (Ovaskainen 2009). Siukola et al. (2018) considered skilled and motivated employees to be the most important resource for a wood-harvesting enterprise. In mechanised cutting, for example, differences of up to 40% have been observed between operators (Kärhä et al. 2004; Purfürst and Erler 2011; Liski et al. 2020). Performance-related payment schemes are associated with higher worker effort, better matches between workers and companies, and lower turnover for a firm’s more productive workers (Lucifora 2015). However, incentive payment systems are applied only in the largest companies, in which the employed operators focused solely on productive work. In other companies, they were also responsible for supporting tasks (e.g. machine relocation).

National agreements between the Finnish forest industry and the contractor party were applied until 1992. The prices were based on forest work studies conducted in varying conditions (Kuitto et al. 1994). In those circumstances, operational efficiency was the key factor determining the profitability of a wood-harvesting enterprise. In Mäkinen’s (1997) study, which covers 1987 to 1991, the most successful enterprises had only one large customer each, which enabled sufficient capacity utilisation within a reasonable operating radius. Large customers had forest departments responsible for planning and supervision, and the harvesting enterprises focused solely on wood harvesting. In the current business environment with new responsibilities, competitive bidding significantly increases the contractor’s risks unless he or she is aware of the productivity and cost of the operations and the business management and leadership skills are inadequate. The full potential of available monitoring systems was not used even in the largest companies in the present study. The respondents acknowledged the potential to increase efficiency, but monitoring was considered to entail too much top-down control.

In the study by Väkevä and Imponen (2001), the increase in the thinning proportion slightly decreased profitability. The present study did not investigate the final allocation of sites between prime and subcontractors, but the thinning proportion may be higher in the site distribution of subcontractors. In the follow-up study by Jylhä et al. (2019), thinning constituted 38% of the harvested volume but consumed 55% of the production time. Compensation for increased time consumption in harvesting prices is a prerequisite for profitable thinning operations.

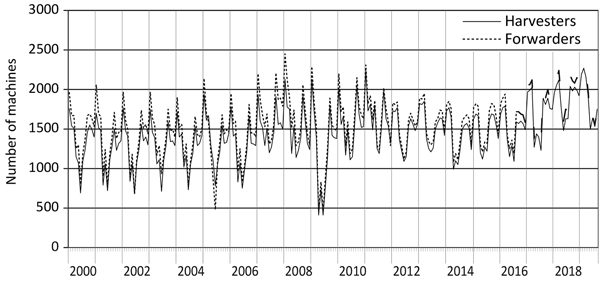

Traditionally, harvesting capacity has been sized to meet the demand of the peak season in winter, which results in the under-utilisation of machinery at other times (Fig. 14). Venäläinen et al. (2017) estimated that seasonal fluctuation in harvesting volumes increases the cost of wood procurement in Finland by 70 million euros annually, 59% of which is a result of excessive capital costs of the harvesting machinery. Climate change with the resultant lack of ground frost (Kokkila 2013) and the fluctuation in the economy further increase the variation in harvesting volumes. These scenarios above occurred in Finland in 2019 when felling volumes started to decline suddenly (Natural Resources… 2019, 2020b). When using subcontractors, the risks associated with the demand for harvesting services are also partially outsourced, but only a few subcontractors in the present study had adequate financial buffers to sustain repetitive layoffs.

Fig. 14. Monthly numbers of harvesting machines used by month in Finland in the 2000s (Natural Resources Institute Finland 2020a).

Management and leadership skills are considered a prerequisite for profitable wood-harvesting businesses (Soirinsuo and Mäkinen 2009). The importance of enhancing these skills was also recognised by the respondents of the present study. Based on the financial and interview data, only a few of them were fully aware of the economic status of their companies. This agrees with the surveys by Lautanen and Tanttu (2013) and Kettunen and Hurttala (2020) who found the awareness of costs and productivity to be the most important knowledge gaps among Finnish wood-harvesting entrepreneurs. In general, the educational level of the entrepreneurs included in the present study was low. Only some had an education in business management, and their companies were more profitable than typical companies in their turnover classes. In the smallest companies, most of the entrepreneurs’ worktime was allocated to operative work and daily routines. With appropriate skills and tools, entrepreneurs would cope, especially with the growth of their businesses (Penttinen et al. 2011).

The prolongation of the negative development in profitability may endanger the sustainability of the wood-harvesting business and increase the vulnerability of the forest industry’s raw material supply. Soirinsuo (2012) considered the incapacity to develop a business model and a lack of adaptability in a changing business environment to be the fundamental reasons for poor profitability. Wood harvesting is a mature business in which product and even process innovations have been rare. The present business environment with greater agreements and demand for versatile services promotes the emergence of process innovations. For example, business mediators could take responsibility for organising versatile forestry services for the customers. Yet the mediator depends on the ability of the subcontractors to fulfil service demands. Erlandsson and Fjeld (2017) emphasised the customer’s responsibility to offer conditions that keep the contractors in business year-round. Allowing profit-making and stable contracts promotes the sustainability of the business (Soirinsuo 2012).

5 Conclusions

A strong position and stable and long-term customer relationship are the results of long-term experience in the wood-harvesting business. Successful enterprises have large networks, and they are capable of providing more versatile services. They also invest more effort in continuously and systematically monitoring the financial situation and operational parameters.

The future development of wood harvesting seems to be polarised: larger enterprises are likely to continue growing, whereas the size of smaller companies has stabilised. Growth can emerge from the willingness to take on greater responsibilities in the wood supply chain. However, profitability is a prerequisite for sustainable growth, and the enhancement of business management skills and the adoption of various business management tools can support this goal. In particular, entrepreneurs running small-scale businesses require a tailored managerial education and even consultancy on a business exit decision if appropriate.

The findings of the present study support the theory of the asymmetry of negotiating power between large customers and small suppliers (Alajoutsijärvi et al. 2001). Therefore, the socioeconomic responsibility of each actor within the forest sector is of great importance because their success promotes the well-being of society.

Acknowledgements

The study was conducted through the FOBIA project (contract no. 187) funded by the Northern Periphery and Arctic Programme 2014–2020, The Ministry of Employment and the Economy and Natural Resources Institute Finland. The contributions from the wood harvesting entrepreneurs involved in the research are highly appreciated.

References

Alajoutsijärvi K., Tikkanen H., Wagtmann M.A. (2001). David against Goliath – coping with adversarial customers. A three-fold relational strategy for SMEs. The Journal of Selling & Major Account Management 3(4): 33–52.

Benjaminsson F., Kronholm T., Erlandsson E. (2019). A framework for characterizing business models applied by forestry service contractors. Scandinavian Journal of Forest Research 34(8): 779–788. https://doi.org/10.1080/02827581.2019.1623304.

Boyatzis R. (1998). Transforming qualitative information: thematic analysis and code development. Sage, Thousand Oaks, CA. 200 p.

CCA. (2013). A guide to the analysis of financial statements of Finnish companies. Committee for Corporate Analysis (Yritystutkimus ry), Gaudeamus. ISBN 978-495-242-2. 108 p.

Eriksson M., Lebel L., Lindroos O. (2017). The effect of customer-contractor alignment in forest harvesting services on contractor profitability and the risk for relationship breakdown. Forests 8(10) article 360. https://doi.org/10.3390/f8100360.

Erlandsson E., Fjeld D. (2017). Impacts of service buyer management on contractor profitability and satisfaction – a Swedish case study. International Journal of Forest Engineering 28(3): 148–156. https://doi.org/10.1080/14942119.2017.1367235.

Feilzer M.Y. (2009). Doing mixed methods research pragmatically: implications for the rediscovery of pragmatism as a research paradigm. Journal of Mixed methods Research 4(1): 6–16. https://doi.org/10.1177/1558689809349691.

Finnish Customs. (2020). ULJAS – international trade statistics. http://uljas.tulli.fi/uljas/. [Cited 05 June 2020].

Hourunranta P. (2013). Suorituskyvyn mittaaminen metsäkoneyrityksissä. [Performance measurement in forest machine enterprises]. Master’s thesis. Lappeenranta University of Technology, Industrial Management. 83 p. http://urn.fi/URN:NBN:fi-fe201310186743. [In Finnish with English abstract].

Hultåker O. (2006). Entreprenörskap i skogsdrivningsbranschen. En kvalitativ studie om utveckling i små företag. [Entrepreneurship in the forest harvesting industry: a qualitative study of development in small enterprises.] Doctor’s dissertation, Swedish University of Agricultural Sciences, Uppsala. Acta Universitas Agriculturae Sueciae 2006:87. 202 p. [In Swedish with English summary].

Jylhä P., Jounela P., Koistinen M., Korpunen H. (2019). Koneellinen hakkuu: seurantatutkimus. [Mechanised cutting: A follow-up study]. Luonnonvara- ja biotalouden tutkimus 11/2019. 53 p. http://urn.fi/URN:ISBN:978-952-326-717-6. [In Finnish].

Kärhä K. (2004). Metsäkoneyritysten kannattavuus 1999–2002. [Profitability of forest machine companies in Finland during the years 1999–2002]. Metsätehon katsaus 6/2004. 4 p. http://www.metsateho.fi/wp-content/uploads/2004/08/Katsaus_05_2004_Julkinen_nro_6.pdf. [In Finnish with English summary]. [Cited 21 Nov 2019].

Kärhä K., Rönkkö E., Gumse S.-I. (2004). Productivity and cutting costs of thinning harvesters. International Journal of Forest Engineering 15(2): 43–56. https://doi.org/10.1080/14942119.2004.10702496.

Kettunen A., Hurttala H. (2020). Digital solutions in the forestry service business. TTS:n julkaisuja 442. 31 p. https://www.tts.fi/files/2033/Fobia_State_of_the_art_report_T3_TTS_01042019.pdf. [Cited 05 June 2020].

Kokkila M. (2013). Ilmastonmuutoksen vaikutus puunkorjuun talvikauden korjuuoloihin hienojakoisella kivennäismaalla. [The effect of climate change on the wintertime wood-harvesting conditions on fine-grained mineral soils]. Metsätieteen aikakauskirja 1/2013:5–18. https://doi.org/10.14214/ma.6028. [In Finnish].

Kotler P. (1988). Marketing management: analysis, planning, implementation, and control. 6th edition. Prentice-Hall, Englewood Cliffs, NJ. 776 p.

Kronholm T., Sosa A., Bowditch E., Pohlschneider S., Hamunen K., Rikkonen P. (2019). State of the art and development needs of forestry service contractors in the Northern Periphery and Arctic region. Project report. https://www.luke.fi/fobia/wp-content/uploads/sites/21/2019/11/State-of-the-art-and-development-needs-of-forestry-service-enterprises-in-the-NPA-region.pdf. [Cited 3 Dec 2019].

Kuitto P.-J., Keskinen S., Lindroos J., Oijala T., Rajamäki J., Räsänen T., Terävä J. (1994). Puutavaran koneellinen hakkuu ja metsäkuljetus. [Mechanized cutting and forest haulage]. Tiedotus 410. Metsäteho. 38 p. + app. [In Finnish with English summary].

Laitinen E., Lukason O., Suvas A. (2014). Behavior of financial ratios in firm failure process: an international comparison. International Journal of Finance and Accounting 2(2): 122–131.

Laki kilpailunrajoituksista 480/1992. [Act on competition restrictions 480/1992]. https://www.finlex.fi/fi/laki/alkup/1992/19920480. [Cited 27 June 2019]. [In Finnish].

Lautanen E., Tanttu V. (2013). Metsäalan ammattiosaaminen nyt ja vuonna 2020. [Professional skills now and in 2020]. TTS:n tiedote, Metsätyö, -energia ja yrittäjyys 7/2013 (768). 12 p. [In Finnish].

Liski E., Jounela P., Korpunen H., Sosa A., Jylhä P. (2020). Modelling the productivity of mechanised CTL harvesting with statistical machine learning methods. International Journal of Forest Engineering. [In press]. https://doi.org/10.1080/14942119.2020.1820750.

van Loggerenberg B.J., Cucchiaro S.J. (1981). Productivity measurement and the bottom line. National Productivity Review (1)1: 87–99. https://doi.org/10.1002/npr.4040010111.

Lucifora C. (2015). Performance-related pay and labor productivity. IZA World of Labor 2015: 152. 10 p. https://doi.org/10.15185/izawol.152.

Magretta J. (2002). Why business models matter. Harvard Business Review 80: 86–92.

Mäkinen P. (1997). Success factors for forest machine entrepreneurs. Journal of Forest Engineering 8(2): 27–35.

Mäkinen P. (2018). Elinvoimainen yrittäjyys 2025. [Viable entrepreneurship 2025]. Presentation, Metsäpäivät 23.11.2018. 18 p. https://www.koneyrittajat.fi/media/Julkinen/Liitteet/Tapahtumat/Metsapaiva2018/03Makinen.pdf. [Cited 21 Nov 2019]. [In Finnish].

Manner V., Järvinen V. (2013). Metsäkoneyritysten tulostaso oli kehno vuonna 2013. [Forest machine enterprises’ profitability level was poor in 2013]. TTS:n tiedote. Metsätyö, -energia ja yrittäjyys 5/2013 (766). 4 p. [In Finnish].

Metsäkonealan työehtosopimus 1.2.2018–31.1.2020. (2018). [Collective labour agreement for the forest machine brand, 1.12.2018–31.1.2020]. https://www.finlex.fi/data/tes/3722/MU23Metskon1802.pdf. [Cited 21 Nov 2019]. [In Finnish].

Murphy G.B., Trailer J.W., Hill R.C. (1996). Measuring performance in entrepreneurship research. Journal of Business Research 36(1): 15–23. https://doi.org/10.1016/0148-2963(95)00159-X.

Natural Resources Institute Finland. (2019). Luke’s review of economic cycles in the forest sector for 2019–2020: the downward trend in the forest industries reduces production and felling volumes. https://www.luke.fi/en/news/lukes-review-of-economic-cycles-in-the-forest-sector-for-2019-2020-the-downward-trend-in-the-forest-industries-reduces-production-and-felling-volumes/. [Cited 12 May 2020]

Natural Resources Institute Finland. (2020a). Statistics database. https://statdb.luke.fi/PXWeb/pxweb/en/LUKE/?rxid=9ad16a36-53a5-4fa7-aaf8-ffe27fa6a858. [Cited 05 June 2020].

Natural Resources Institute Finland. (2020b). Industrial roundwood removals and labour force 3/2020. Statistics publication 05.05.2020. https://stat.luke.fi/en/commercial-roundwood-removals-and-forestry-labour. [Cited 12 May 2020].

Osterwalder A., Pigneur Y. (2005). Clarifying business models: origins, present, and future of the concept. Communications of the Association for Information Systems 16: 1–25. https://doi.org/10.17705/1CAIS.01601.

Osterwalder A., Pigneur Y. (2010). Business model generation: a handbook for visionaries, game changers and challengers. John Wiley & Sons, Hoboken, New Jersey. 288 p.

Ovaskainen H. (2009). Timber harvester operator’s working technique in first thinning and the importance of cognitive abilities on work productivity. Dissertationes Forestales 79. 62 p. https://doi.org/10.14214/df.79.

Penrose E. (2009). The theory of the growth of the firm. With a new introduction by Christos N. Pitelis. Fourth edition. Oxford University Press Inc., New York. 304 p.

Penttinen M., Rummukainen A., Mikkola J. (2011). Profitability, liquidity and solvency of wood harvesting contractors in Finland. Small Scale Forestry 10(2): 211–229. https://doi.org/10.1007/s11842-010-9143-x.

Purfürst T., Erler J. (2011). The human influence on productivity in harvester operations. International Journal of Forest Engineering 22(2): 15–22. https://doi.org/10.1080/14942119.2011.10702606.

Siukola A., Pursio H., Liukkonen P., Vänni K., Uitti J., Liukkonen V., Kosonen H., Nygård C.-H. (2018). Työhyvinvointi puunkorjuuyritysten menestymisen tukena. [Wellbeing as a support for the success of wood-harvesting enterprises]. Working Papers 101/2018. Tampereen yliopisto, Työelämän tutkimuskeskus. 77 p. http://urn.fi/URN:ISBN:978-952-03-0926-8. [In Finnish].

Soirinsuo J. (2012). Growth and profitability of logging and transportation in wood procurement companies in Finland: what strategies and entrepreneurs are needed for profitable growth? Publication no. 54. University of Helsinki, Department of Economics and Management. 90 p. + app. http://urn.fi/URN:ISBN:978-952-10-8386-0.

Soirinsuo J., Mäkinen P. (2009). Importance of the financial situation for the growth of a forest machine entrepreneur. Scandinavian Journal of Forest Research 24(3): 264–272. https://doi.org/10.1080/02827580902932829.

Statistics Finland. (2019). Investments and fixed capital. http://pxnet2.stat.fi/PXWeb/pxweb/en/StatFin/StatFin__kan__vtp/statfin_vtp_pxt_124l.px/. [Cited 27 June 2019].

Suomen Asiakastieto Oy. (2018). Voitto+. Financial statement data 2013–2017. CD-ROM. https://www.asiakastieto.fi/voitto/ohje/voitto1_eng.htm.

Teece D.J. (2010). Business models, business strategy and innovation. Long Range Planning 43(2–3): 172–194. https://doi.org/10.1016/j.lrp.2009.07.003.

The Trade Association of Finnish Wood Harvesting and Earth Moving Contractors. (2019). Nousun hedelmät jäivät koneyrityksiltä saamatta. [Machine enterprises did not benefit from the fruits of the upturn]. Press release 18.10.2019. https://www.koneyrittajat.fi/pages/etusivu/medialle/tiedotteet/tiedotteet2019/20191018.php. [Cited 21 Nov 2019]. [In Finnish].

The Trade Association of Finnish Wood Harvesting and Earth Moving Contractors. (2020). Unpublished turnover distribution of wood-harvesting member companies (Ltds), based on the statics of Finnish Patent and Registration Office and Bisnode Oy.

Väkevä J., Imponen V. (2001). Puutavaran korjuu- ja kuljetusyritysten kannattavuus vuosina 1995–2000. [Profitability of wood-harvesting and transport enterprises, 1995–2000]. Metsätehon raportti 125. Metsäteho Oy. 67 p. http://www.metsateho.fi/wp-content/uploads/2015/02/metsatehon_raportti_125.pdf. [Cited 6 Sept 2019]. [In Finnish].

Väkevä J., Rajamäki J., Imponen V., Pennanen,O. (1999). Puutavaran korjuu- ja kuljetusyritysten kannattavuus vuosina 1994–97. [Profitability of wood-harvesting and transport enterprises, 1994–1997]. Metsätehon raportti 77. 61 p. http://www.metsateho.fi/wp-content/uploads/2015/02/metsatehon_raportti_077.pdf. [Cited 6 September 2019]. [In Finnish].

Venäläinen P., Alanne H., Ovaskainen H., Poikela A., Strandström M. (2017). Kausivaihtelun kustannukset ja vähentämiskeinot puun toimitusketjussa. [The costs and reduction of seasonal variation in the wood supply chain]. Metsätehon tuloskalvosarja 8/2017. http://www.metsateho.fi/kausivaihtelun-kustannukset-ja-vahentamiskeinot/. [Cited 05 June 2020]. [In Finnish].

Wheelen T.L., Hunger J.D. (1995). Strategic management and business policy. 5th edition. AddisonWesley, Reading, Ma. 434 p.

Winquist E., Rikkonen P., Pyysiäinen J., Varho V. (2019). Is biogas an energy or a sustainability product? – Business opportunities in the Finnish biogas branch. Journal of Cleaner Production 233: 1344–1354. https://doi.org/10.1016/j.jclepro.2019.06.181.

Total of 52 references.