Strategic business networks in the Finnish wood products industry: a case of two small and medium-sized enterprises

Mattila O., Hämäläinen K., Häyrinen L., Berghäll S., Lähtinen K., Toppinen A. (2016). Strategic business networks in the Finnish wood products industry: a case of two small and medium-sized enterprises. Silva Fennica vol. 50 no. 3 article id 1544. https://doi.org/10.14214/sf.1544

Highlights

- Network-based business models are not yet common in the wood products industry

- Further research is suggested on network-based co-operation to vitalize industry.

Abstract

The use of network-based business models has been brought up as a means of creating com-petitive edge in the tightening global competition. In practice, adopting network-based models has not yet become common in the wood products industry. The objective of this study is to gain better understanding of types of network-based business models using a case study of two small and medium-sized wood industry companies in Finland (for a sake of anonymity named as A and B). The network of company A is found to consist of mostly of established actors with a new-in-the-market value creation system, whereas network for company B is more stable and has an established value system aiming at growth and incremental innovations. Both networks had experienced difficulties in finding partners and lacked some strategic resources. Via this example we wish to stimulate further research interest on the sources of network-based competitive advantage in the traditional wood product industry in a need of renewal of business models.

Keywords

competitive advantage;

wood products;

network-based business models

- Mattila, University of Helsinki, Department of Forest Sciences, FI-00014 Helsingin yliopisto, Finland E-mail osmo.mattila@helsinki.fi

- Hämäläinen, Siparila Oy, Varaslahdentie 1, FI-40800 Vaajakoski, Finland E-mail kaisa.hamalainen@siparila.fi

- Häyrinen, University of Helsinki, Department of Forest Sciences, FI-00014 Helsingin yliopisto, Finland E-mail liina.hayrinen@helsinki.fi

- Berghäll, University of Helsinki, Department of Forest Sciences, FI-00014 Helsingin yliopisto, Finland E-mail sami.berghall@helsinki.fi

- Lähtinen, University of Helsinki, Department of Forest Sciences, FI-00014 Helsingin yliopisto, Finland E-mail katja.lahtinen@helsinki.fi

-

Toppinen,

University of Helsinki, Department of Forest Sciences, FI-00014 Helsingin yliopisto, Finland

E-mail

anne.toppinen@helsinki.fi

Received 5 January 2016 Accepted 12 April 2016 Published 19 April 2016

Views 58819

Available at https://doi.org/10.14214/sf.1544 | Download PDF

Supplementary Files

1 Introduction

The Finnish wood products industry has during the 2010s been suffering from long-standing economic recession, which in Europe has been intensified by increased competition from low-cost production countries and substitute products. Wood products industry and its main industrial customer, construction sector, are good examples of businesses, in which the physical products do not only enable meeting the basic level of customer needs (e.g., living in a house), but also have potential to a broader service provision related to, e.g., self-expression of people (e.g., habitants’ lifestyle).

Although for customers physical characteristics of products are only a part of value creation (Vargo and Lusch 2004), wood product companies are often focusing on production efficiency instead of contributing to adding value to offerings (Toppinen et al. 2013). In previous research, inter-firm collaboration has often been brought up as a means of creating competitive edge in tightening global competition in which traditional production orientation does no longer seem to pay off (Toppinen et al. 2011).

The role of service sector is globally growing and recognized also in the forest sector (Toppinen et al. 2013). However, according to Mattila (2015), the lack of dynamic middle-sized companies with a cooperative mind is a hindrance for the Finnish forestry sector renewal. Majority of the wood industry companies in Finland are small or medium-sized enterprises (SMEs), which often struggle with a lack of dynamic capabilities to cope with rapidly changing environment (Teece et al. 1997). According to Jarillo (1993), in comparison to vertically integrated companies, business networks are more capable forms of organizations to react to rapid market changes. Thus, by increasing the level of networking among SMEs, more successful and customer oriented business models could be gained.

Despite the potential advantages of networking (Varamäki and Vesalainen 2003), networks have not been in previous studies for sawmilling industry seen as a strategic resource (Toppinen et al. 2011). Nevertheless, while benefits from networking in wood industry seem to exist (e.g., Lähtinen et al. 2009) there is lack of research on this topic, especially from the service development point of view. The objective of the study is to partly fill this gap by analysing the network structure and functioning around two illustrative wood products companies that have prior experience from active business networks (named as A and B).

2 Material and methods

2.1 Conceptual framework

Networks are long-term relationships between two or more organisations (Thorelli 1986). They can be loose or tight depending on the number of members, level of commitment and interaction (Williamson 1975; Thorelli 1986). Networks can be borderless, self-organizing systems emerging from interaction or more intentionally created ‘strategic networks’ (Jarillo 1993). Different types of networks require different types of management, and value creation logic is fundamental in influencing effective mechanisms for governance (Möller and Rajala 2007). According to Morgan and Hunt (1994), trust and commitment are important elements for any business relationships. From the viewpoint of networking, Varamäki and Vesalainen (2003) argue that participation is a key challenge among the SMEs. Ireland et al. (2002) name the network partner selection to be a starting point for efficient and profitable network.

Möller and Rajala (2007) have identified and placed value nets on a value-system continuum, while innovation networks are typically loose research and development (R&D) based networks (Table 1). Current business nets on the left hand side are relatively stable with high level of resources. Nets targeting renewal of business aim at increasing the network efficiency by improving specific parts of the business processes either continuously or as project-based. Emerging business nets concern radical, discontinuous and system-wide changes, in which new technologies, business concepts or even business fields are being created. Under this category, application nets generally have a hub company (so called network integrator) while dominant design nets consist of companies that proactively try to create coalitions.

| Table 1. Business net classification framework (modified from Möller and Rajala 2007). | ||||||

| Current Business Nets | Business Renewal Nets | Emerging Business Nets | ||||

| Vertical Demand-Supply Nets High level of determination | Horizontal Market Nets | Business Renewal Nets | Customer Solution Nets | Application Nets | Dominant Design Nets | Innovation Networks Low level of determination |

Stable value system

| Established value system

| Emerging value system

| ||||

2.2 Data and analysis

The qualitative interviews were based on the theoretical concepts illustrated in previous literature and in Table 1. Data gathering was implemented in the end of 2013 by composing five managerial level interviews in the network of company A and four in the network of company B. Both case companies operate in wood product business, but are not actual competitors to each other because of different product portfolios. Company A is a relatively new actor in wood construction sector. Its business model includes the whole construction value chain from planning to installation and maintenance. Instead, company B has a more traditional business model producing wooden claddings and other construction materials. It provides a complete service package with a network to support installation and maintenance together with its’ partner. From the research point of view, the selected companies are interesting because of their wish to operate via a network-based business models.

The representatives of company A and B and their network partners were interviewed in person by using framework presented in the Appendix. During this process, innovations were only rarely discussed and in connection with identification of future opportunities, that these are merged in results (Table 2). In addition, many of the interviewees also wished to comment on the general situation in the Finnish wood products sector, which is incorporated in Table 2 as the third column to put network specific findings into better context. In addition to managers of companies A and B, we also interviewed one leading expert of wood product industry to build insight into the general industry setting.

| Table 2. Summary of results. | |||

| Elements | Network of company A | Network of company B | Current state of networking in wood products industry |

| Structure and business idea | A hub company and balanced network partners; a shared goal | A hub company with partners concentrating on their own core competencies | Networking at low level, but some opportunities identified |

| Goals of the business network | Offering substitutes to concrete elements | High quality wooden claddings with full services, economic value | Promoting internationalisation, larger offer sizes |

| Network partner selection criteria | Track record in wood construction sector, networking skills | Relationships and earlier collaboration, proper financial management | Building image, track record, high quality of work |

| Benefits and opportunities | Innovativeness as opportunity in a specialist network | Better scalability if new partners are found | Improved profitability, larger deals for customers |

| Strategic resources | Lacking in installation and operative management of the industrial plant | Lack of salesforce and difficulties in finding good partners | Increasing role of customers requires resource integration for small companies |

| Openness, trust and commitment | Open atmosphere, dialogic and trustful culture | Commitment based on contracts, more openness needed | Openness and trust as a starting point |

| Challenges | Current poor economic situation, threat of imitation, resource allocation problems | Current poor economic situation, difficulties in finding partners | Current poor economic situation; suspicious attitude towards competitors |

On average, the 10 interviews lasted 31 minutes. All the interviews were recorded and transcribed, and the data were analysed by classifying into theory driven themes. In addition, a new category “Challenges” emerged from market point of view and is added in Table 2. All interviewed managers had good knowledge on the networking issues in their companies. Despite a limited number of interviewees, the data were rather comprehensive in covering the scope of two networks and the theoretical setting. During the interview process, saturation of data could be largely reached for the main concepts under discussion.

3 Results

Among the interviewees, networking was seen to provide much potential in the Finnish wood product industry, as the following quote illustrates: “If you have to offer variety of products, solutions, have a good marketing system, sales and visibility, the only way the SMEs can do it is to create a network or alliance with a coherent strategy”. Alone, SMEs can only have a very limited assortment of products and services. Despite the positive attitudes towards networking, lack of courage in seeing competitors as potential partners was mentioned to hinder their development. It was therefore identified as the main challenge in Table 2, together with currently poor market situation.

Network structure of company A

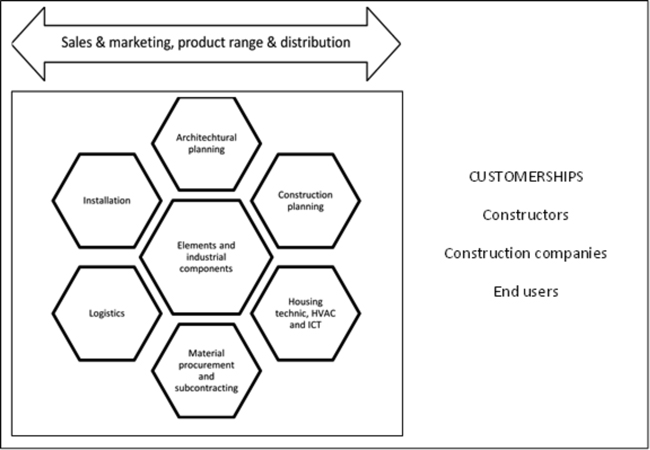

Company A produces wooden elements for construction business, and it has a central role in the network offering alternative solutions for concrete construction elements. Company A’s business focus is on offering tailored full services in a network consisting of architectural planning, construction planning, building services, including heating, ventilation and air conditioning (HVAC), ICT, material procurement and subcontracting, logistics and installation (Fig. 1).

Fig. 1. Company A network structure.

The main idea of this network is that members work in close connection as balanced partners, who perceive shared goals to be crucial for competitiveness. To customers, the network offers complete and competitive building services. This kind of a network was said to be something unusual in the sector: “This may be the first one in Finland but were are not any kinds of pilots. This is a common way to build in Sweden, Norway, Austria, Switzerland and Germany”. According to the interviewees, the key success factor has been the choosing of network partners on the basis of positive experiences of collaborative projects, their strong track record in wood construction business, capabilities to commit to the shared goals and the ability of a network to learn.

As benefits from networking the members mentioned increased capacity to offer larger entities and higher efficiency in marketing activities. In the future, combining network’s resources at deeper level was seen as a possibility to offer services to a larger customer groups and also to international markets. Potential innovativeness originating from the network structure combining different kinds of specialists was also seen as benefit, as the following quote illustrates: “It is clear that this kind of network has potential to innovate and come up with new ideas and solutions. This alliance structure is innovative by its nature”. However, general low level of innovativeness in the wood products sector was criticized as being a barrier for renewal.

Network structure of company B

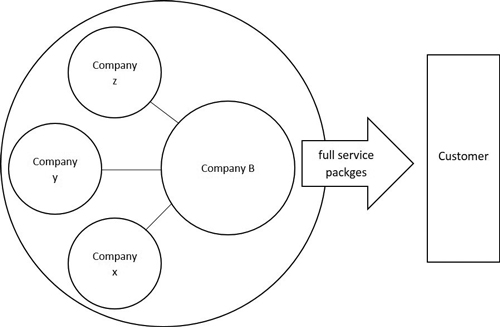

Company B manufactures wooden claddings and other construction materials and sells installation services of these products. It does not have own labour for installation, but it uses a large network of sub-contractors. Towards installation companies the collaboration is, however, perceived as deeper than sub-contracting (Fig. 2). Key responsibility areas are clearly described between the network partners. Network-based business started from a large customer project, which helped the partners to focus on their own core competencies and this in-depth collaboration increased the total quality of the service process. Choosing of network partners was claimed to be based on their good reputation and solidity: “If we don’t accept some partner, the reason may be because of their poor financial management.”

Foreseen business growth in this business was seen to set some challenges because communication has been based on close geographic location of the partners. Resources of the network of company B are currently sufficient, but scalability of the network is questionable since installation companies are operating only locally. There are also issues in maintaining openness when company B is the only one working at the customer interface, as pointed out by a partner: “If we only could reach the level of openness when I was involved in negotiations.”

Fig. 2. Company B network structure.

Table 2 compares the main elements found in this study, illustrating that the network-based of company A is close to creating a strategic value network, according to a classification by Möller and Rajala (2007), with clearly defined member roles and shared goals in development of wooden multi-story housing. However, the network around company A lacks some strategic resources and would benefit from a deeper customer involvement. Instead, the company B network is closer to a subcontracting mode with a wider variety of goals, and it aims at reaching better scalability and increasing the size of the business. Network around company B could benefit from more open culture for co-operation in order to reach higher benefits from co-operation.

In general, networks were seen to have potential in the Finnish wood products sector, especially for SMEs by offering them strategic resources towards growth and internationalisation. Areas for improving cost efficiency were also identified. However, the traditional culture in the industry emphasizes short-term profits and there seems to be lack of trust towards other players in the market. In addition, customers and end-users are only rarely embedded in the decision making processes, decreasing the scope for customer orientation.

4 Discussion and conclusions

Qualitative interview based approach was found to be a suitable method to better understand variation in networking-based business logics, and the data were found to saturate despite of the rather small number of interviews. Based on the results, the two companies have very different network business models according to classification by Möller and Rajala (2007) (Table 2). The network around company B is more stable and has an established value system reaching for incremental improvements, while the network of company A consists mostly of established actors who have created a new-in-the-market value creation system. Regarding the network B, issues with openness among partners were raised, whereas in the case of emerging network around company A, a higher customer involvement would be fruitful. In comparison to an earlier study of the Finnish sawmilling industry SMEs (Toppinen et al. 2011), our findings suggest a more positive attitude towards network-based business models. However, the selected two case companies do not represent the whole wood products industry, but are more as frontrunners in adopting network-based business models.

Despite the positive development, both case company networks were found to lack some strategic resources and both had also experienced difficulties in finding suitable partners. Thus, there is much room for future research on the practical difficulties in creating network-based business models in the Finnish wood products industry even though their potential is widely recognized. Future research could, for example, focus on the elements such as the lack of communication and trust towards competitors as partners, perceived threat of imitation in the business models, or too strong emphasis on short-term efficiency goals instead of creating customer value.

Acknowledgements

Financial support from Tekes Finnish Innovation Agency (FORTUNE project 440132) and Academy of Finland (FORESCOF project 278363) is gratefully acknowledged. We also thank for helpful comments received from the two reviewers and the Editor of Silva Fennica.

References

Ireland R., Hitt M., Vaidyanath D. (2002). Alliance management as a source of competitive advantage. Journal of Management 28(3): 413–446. http://dx.doi.org/10.1177/014920630202800308.

Jarillo J.C. (1993). Strategic networks: creating the borderless organizations. Butterworth-Heinmann, Oxford.

Lähtinen K., Toppinen A., Leskinen P., Haara A. (2009). Resource usage decisions and business success: a case study of Finnish large- and medium-sized sawmills. Journal of Forest Products Business Research 6(3): 1–18.

Mattila O. (2015). Towards service-dominant thinking in the Finnish forestry service market. Dissertationes Forestales 198. http://dx.doi.org/10.14214/df.198.

Möller K., Rajala A. (2007). Rise of strategic nets – new models of value creation. Industrial Marketing Management 36(7): 859–908. http://dx.doi.org/10.1016/j.indmarman.2007.05.016.

Möller K., Rajala A., Svahn S. (2005). Strategic business nets – their type and management. Journal of Business Research 58(9): 1274–1284. http://dx.doi.org/10.1016/j.jbusres.2003.05.002.

Morgan R.., Hunt S.D. (1994). The commitment-trust theory of relationship marketing. The Journal of Marketing 58: 20–38. http://dx.doi.org/10.2307/1252308.

Teece D., Pisano G., Shuen A. (1997). Dynamic capabilities and strategic management. Strategic Management Journal 18(7): 509–533. http://dx.doi.org/10.1002/(SICI)1097-0266(199708)18:7<509::AID-SMJ882>3.0.CO;2-Z.

Thorelli H. (1986). Networks: between markets and hierarchies. Strategic Management Journal 7(1): 37–51. http://dx.doi.org/10.1002/smj.4250070105.

Toppinen A., Lähtinen K., Leskinen L.A., Österman N. (2011). Network co-operation as a source of competitiveness in medium-sized Finnish sawmills. Silva Fennica 45(4): 743–759. http://dx.doi.org/10.14214/sf.102.

Toppinen A., Wan M., Lähtinen K. (2013). Strategic orientations in the global forest sector. In: Hansen E., Panwar R., Vlosky R. (eds.). Global forest sector: changes, practices and prospects. Chapter 17. CRC Press, Boca Raton, FL. http://dx.doi.org/10.1201/b16186-22.

Varamäki E., Vesalainen J. (2003). Modelling different types of multilateral co-operation between SMEs. Entrepreneurship & Regional Development 15(1): 27–47. http://dx.doi.org/10.1080/08985620210157646.

Vargo S., Lusch R. (2004). Evolving to a new dominant logic for marketing. Journal of Marketing 68: 1–17. http://dx.doi.org/10.1509/jmkg.68.1.1.24036.

Williamson O. (1975). Markets and hierarchies: analysis and antitrust implications: a study in the economics of internal organization. Free Press, New York.

Total of 14 references.